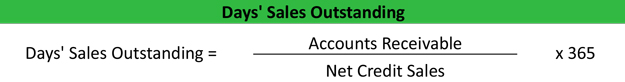

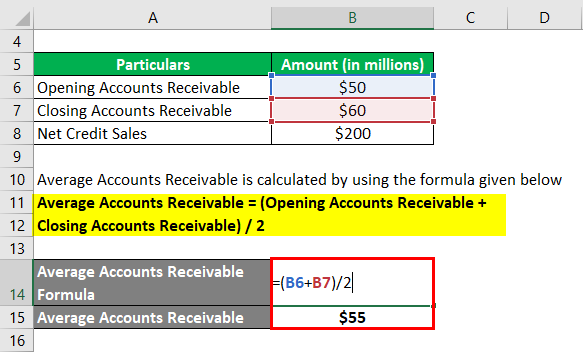

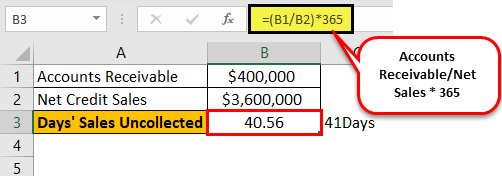

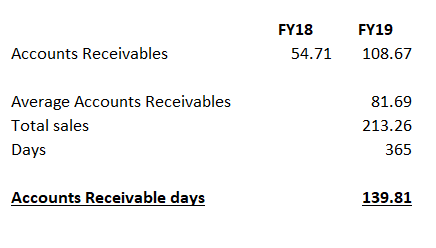

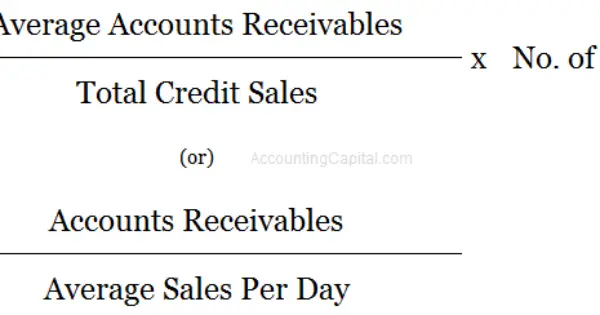

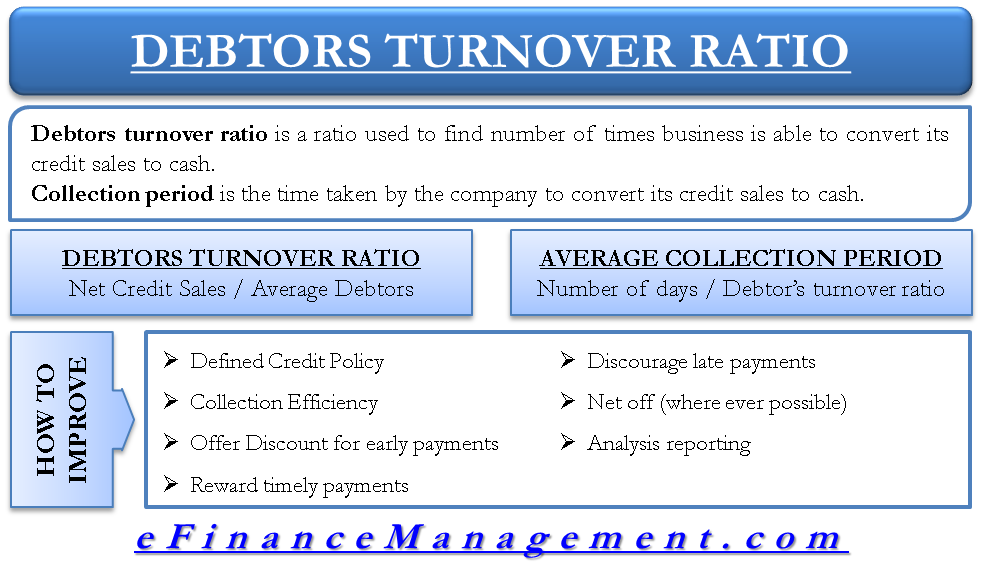

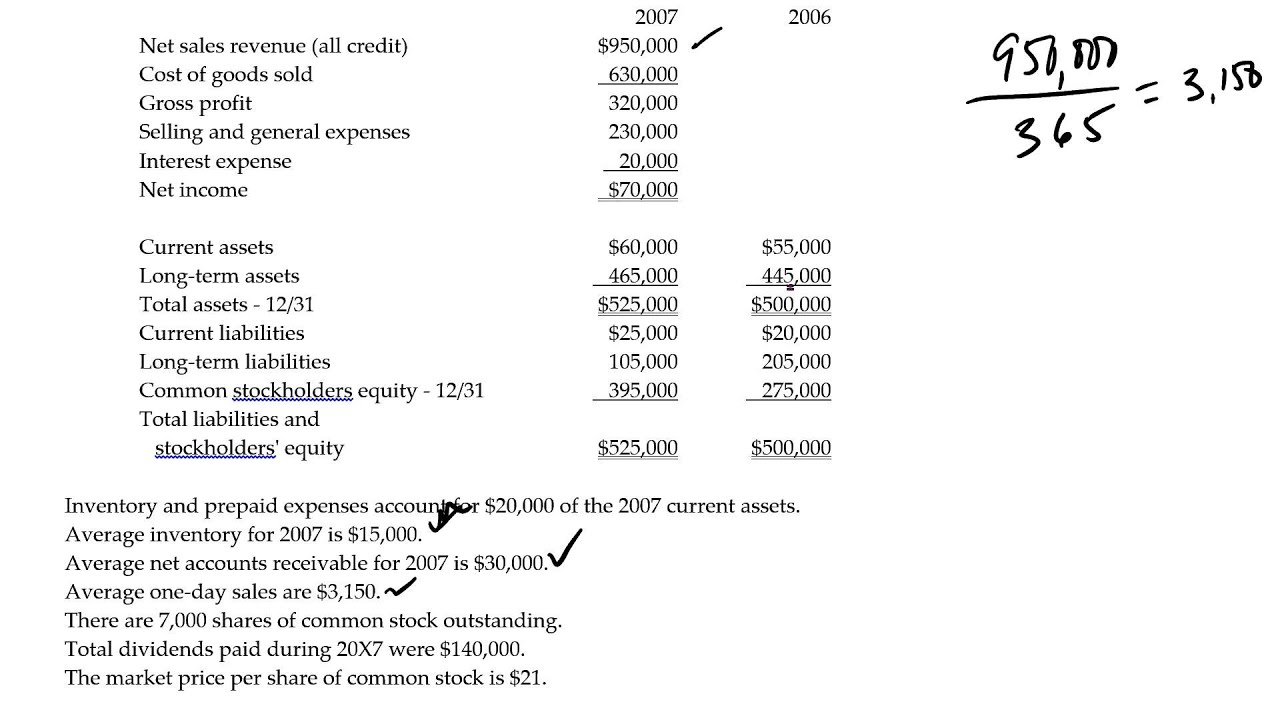

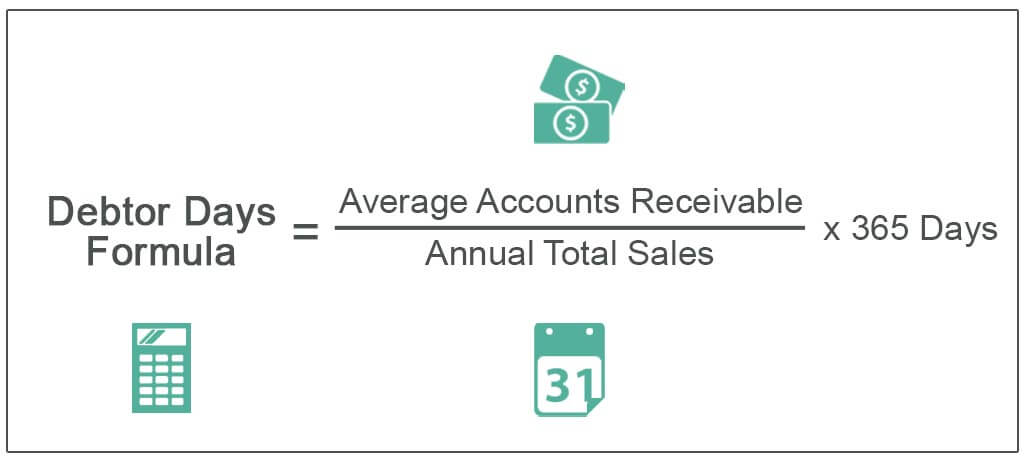

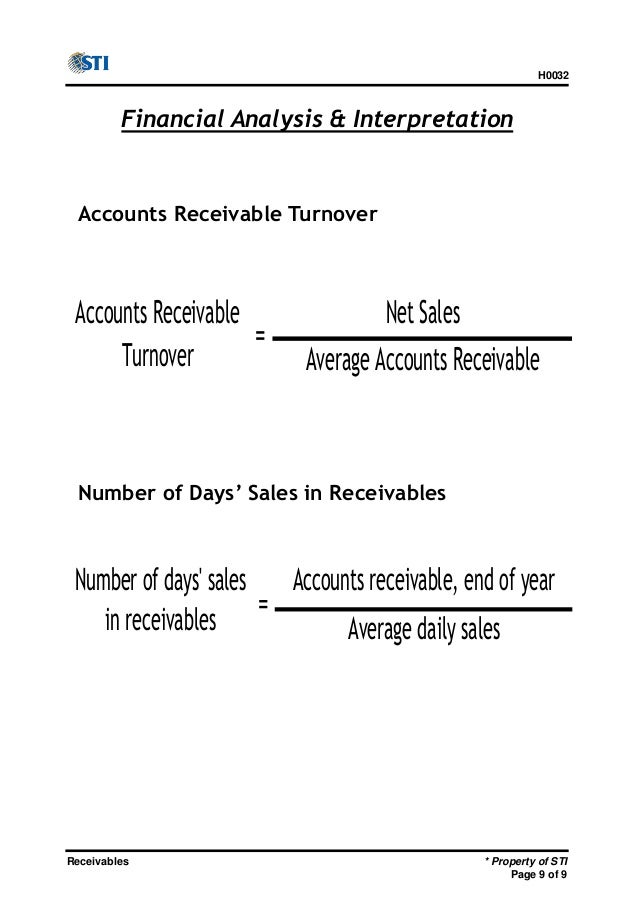

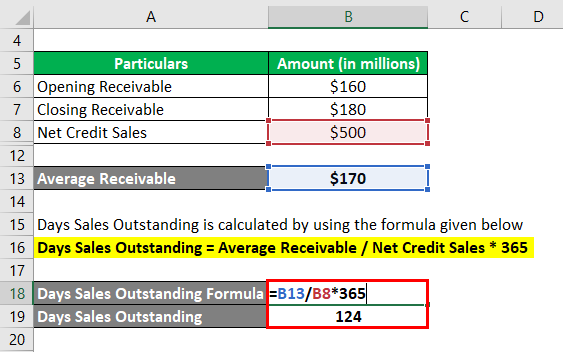

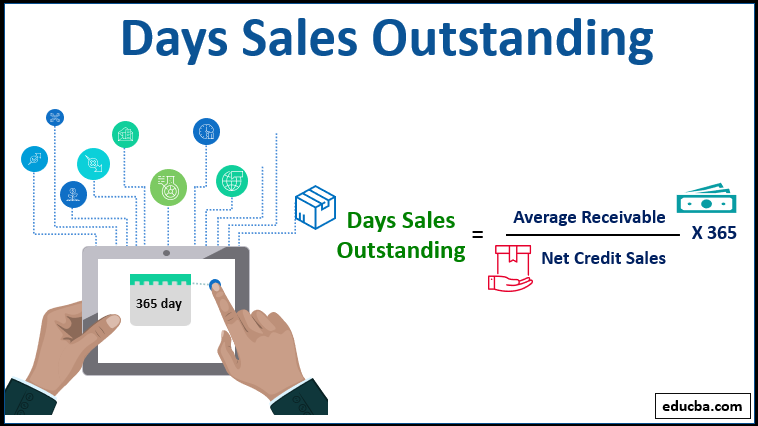

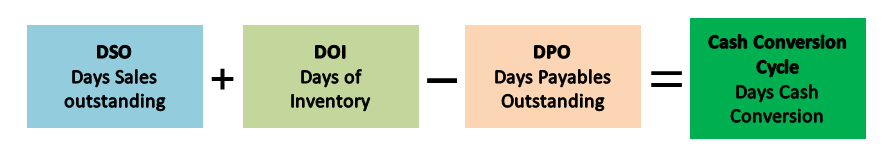

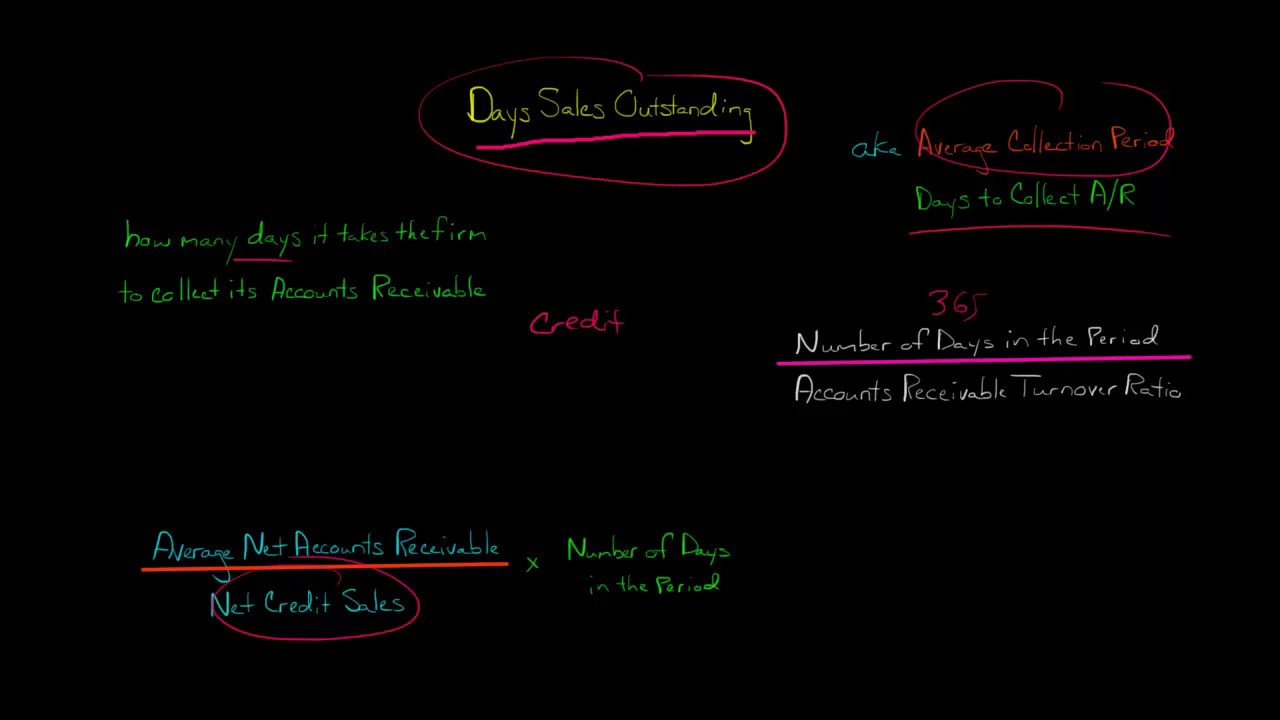

DSO = Accounts Receivable / (Net Sales / # of Days) Let's break down this formula further with some definitions of the key metrics involved Accounts Receivable Your accounts receivable live on the balance sheet and is independent of the time frame you selected It shows all the money you are currently owed by customersThe days sales outstanding formula is as follows Divide the total number of accounts receivable during a given period by the total value of credit sales during the same period and multiply the Debtor Days Formula = (Average Accounts Receivable / Annual Total Sales) * 365 days Receivable Days Formula can also be expressed as average accounts receivable by average daily sales Receivable Days Formula is represented as, Debtor Days Ratio = (Average accounts receivable / Average daily sales)

Days Sales Outstanding Dso Ratio Formula Calculation

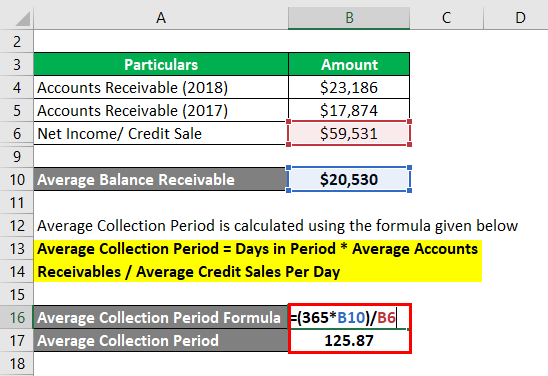

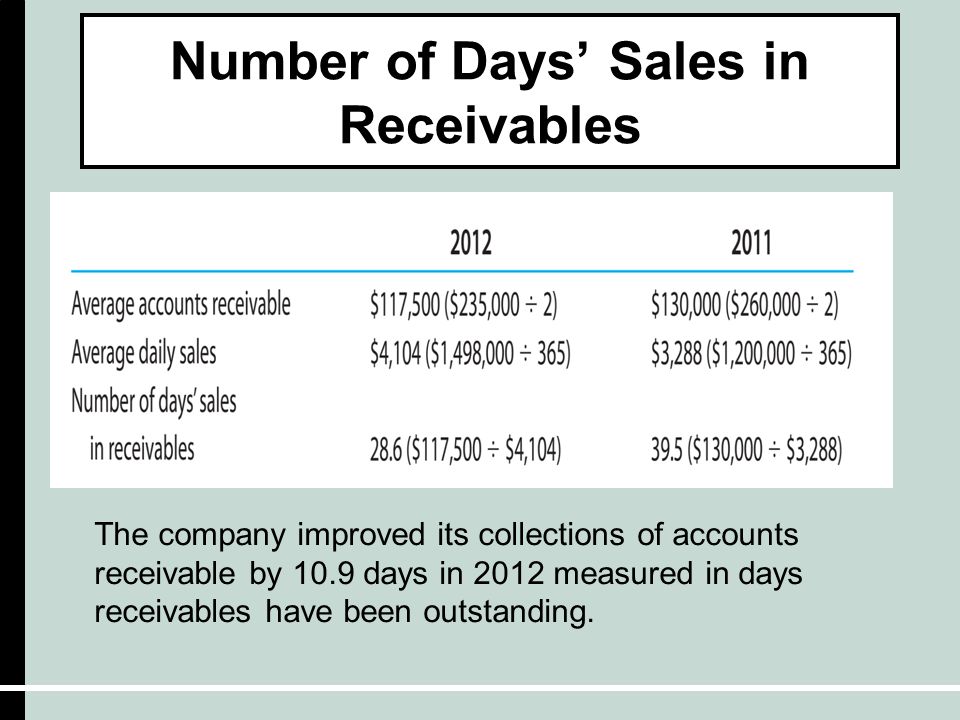

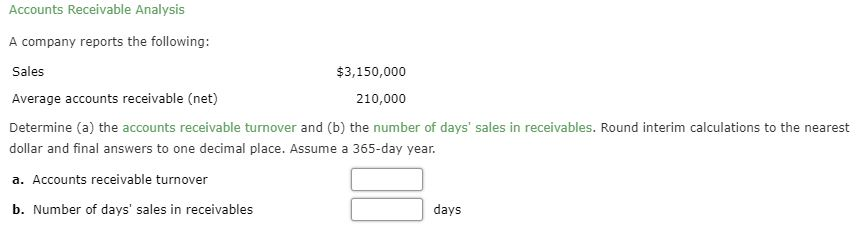

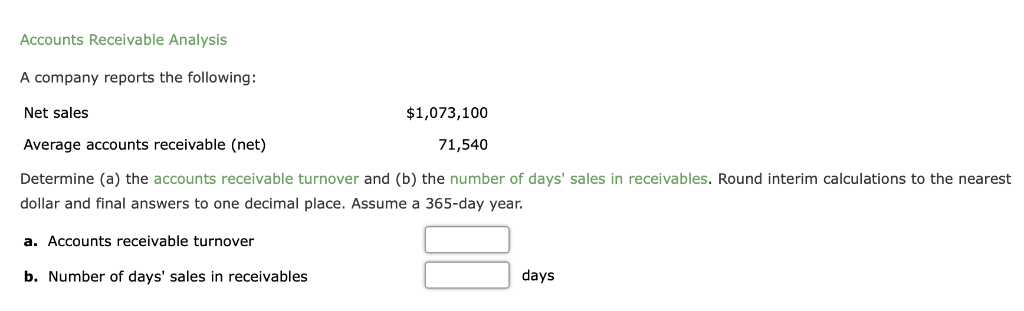

How to calculate days sales receivables

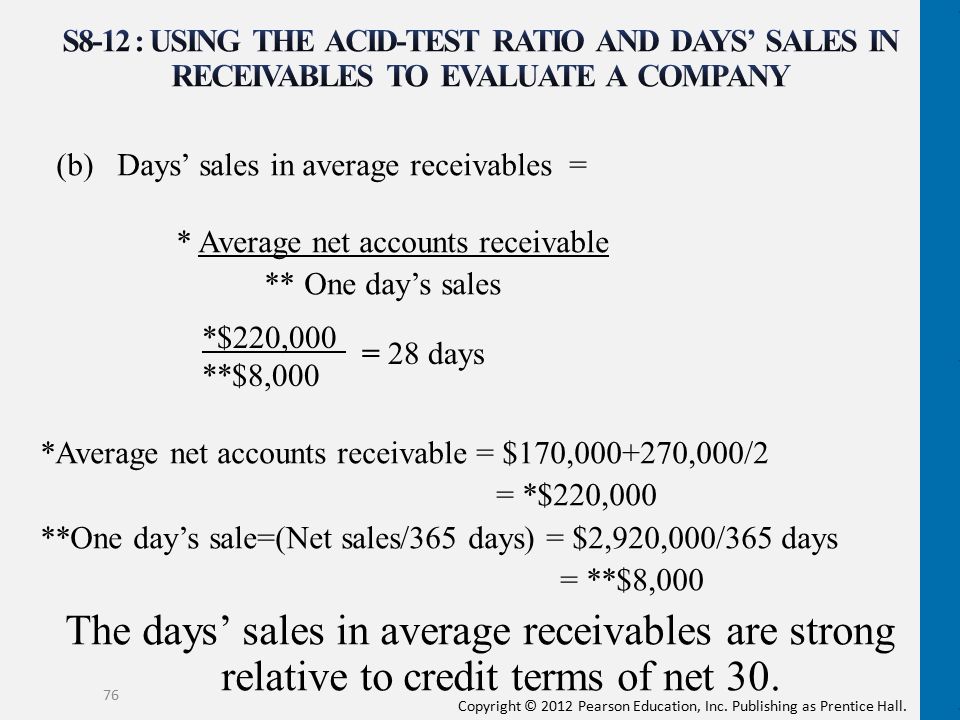

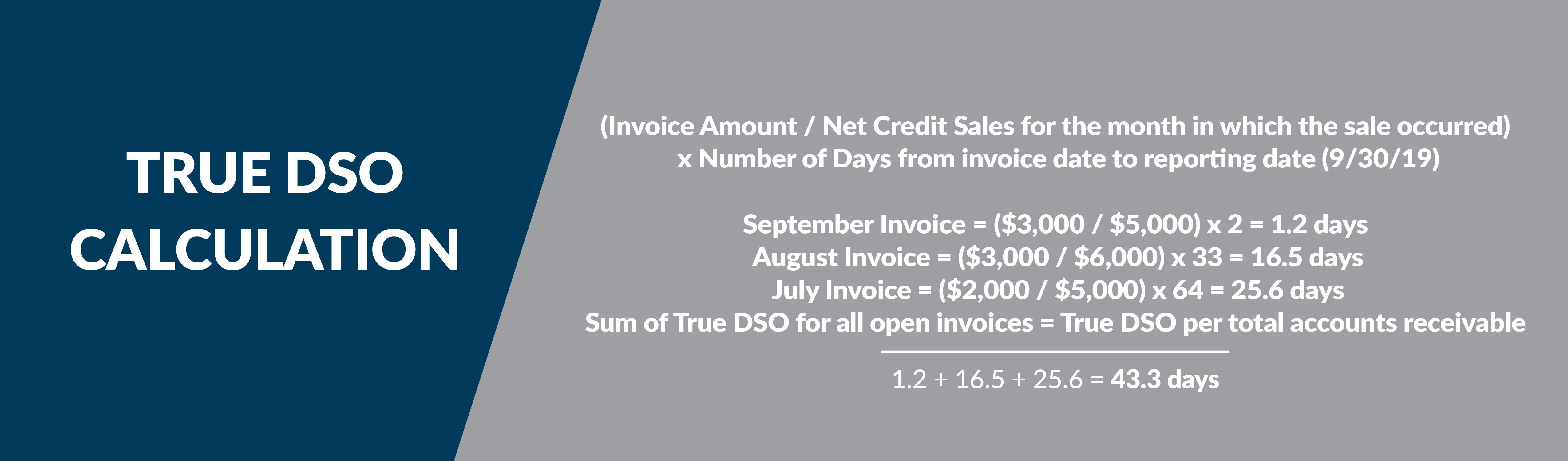

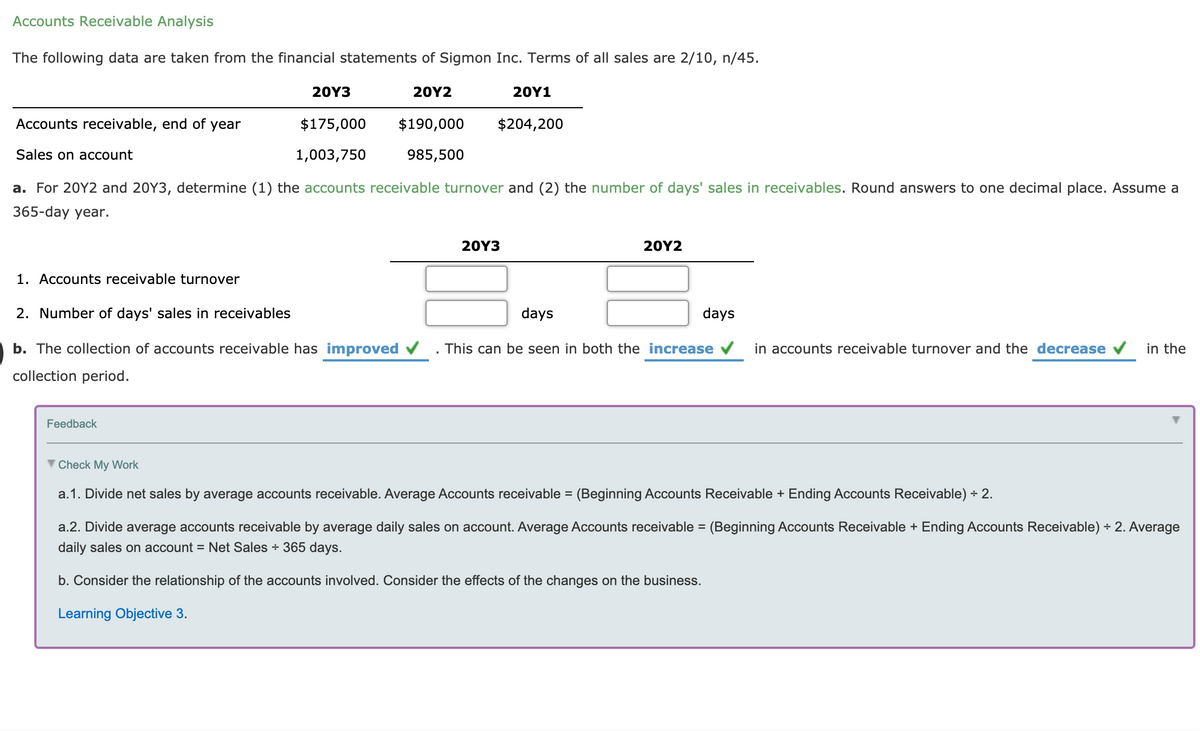

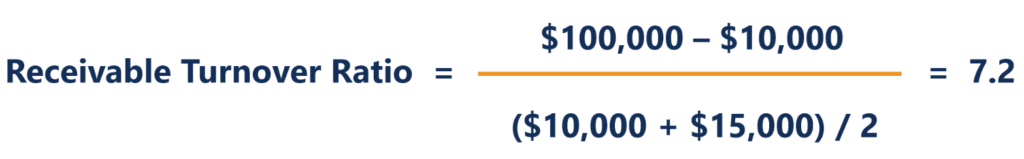

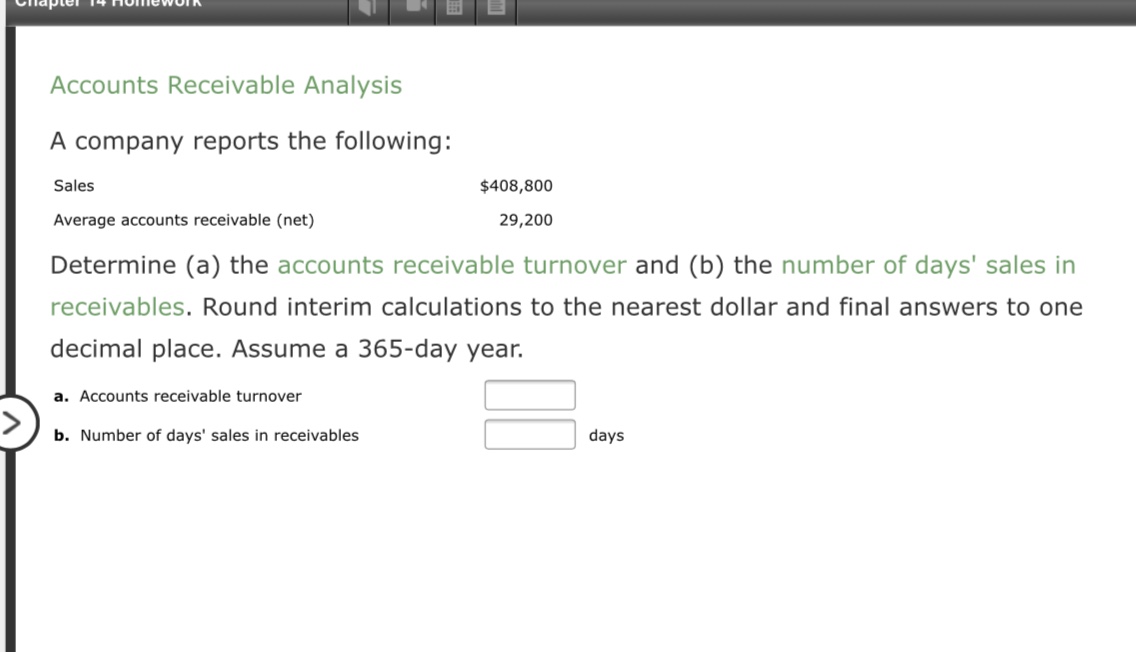

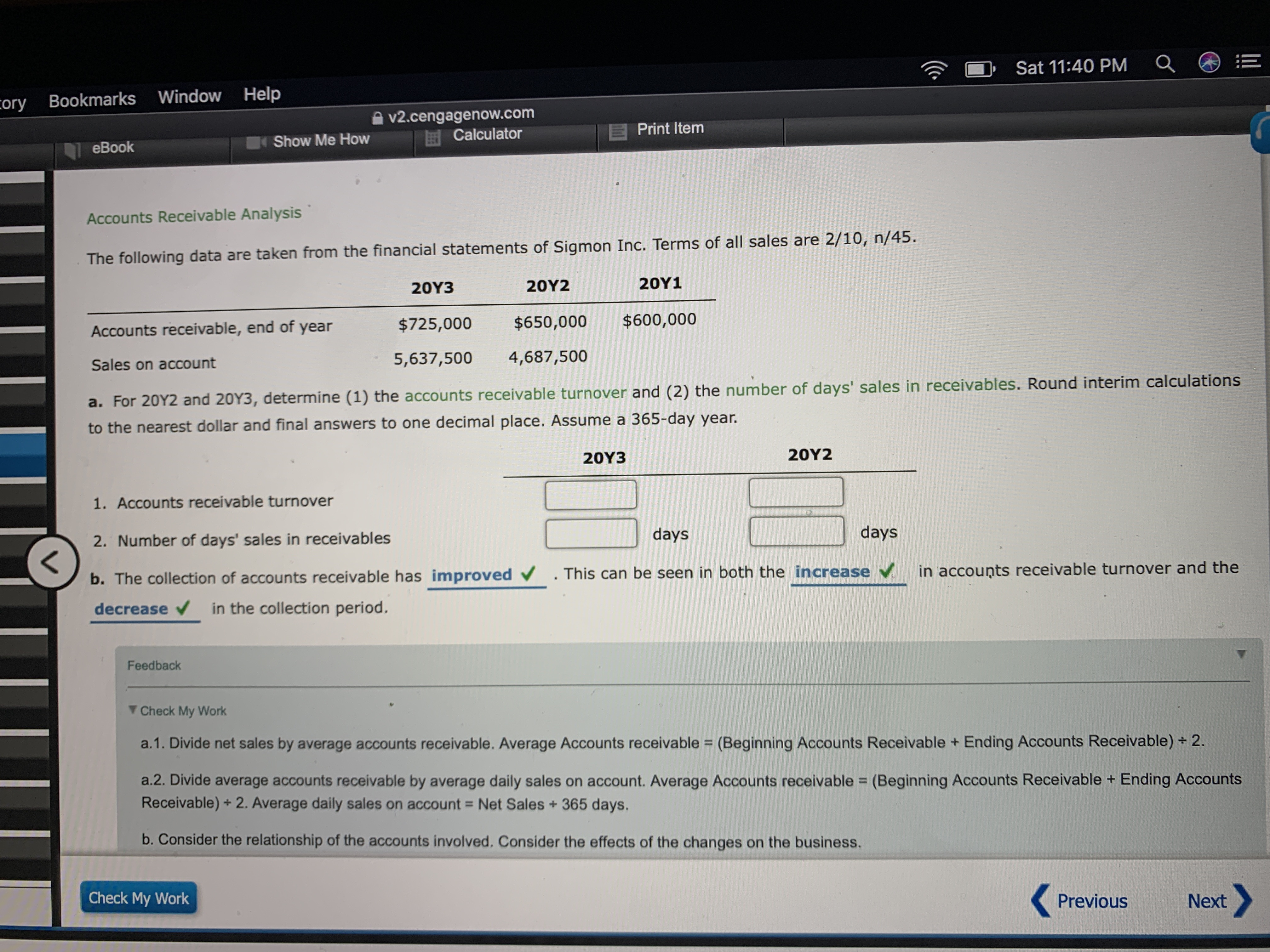

How to calculate days sales receivables-The average collection period is the average number of days between 1) the dates that credit sales were made, and 2) the dates that the money was received/collected from the customers The average collection period is also referred to as the days' sales in accounts receivable Formula for Calculating the Average Collection PeriodNet Annual Credit Sales ÷ ((Beginning Accounts Receivable Ending Accounts Receivable) / 2) For example, a company wants to determine the company's accounts receivable turnover for the past year In the beginning of this period, the beginning accounts receivable balance was $316,000, and the ending balance was $384,000

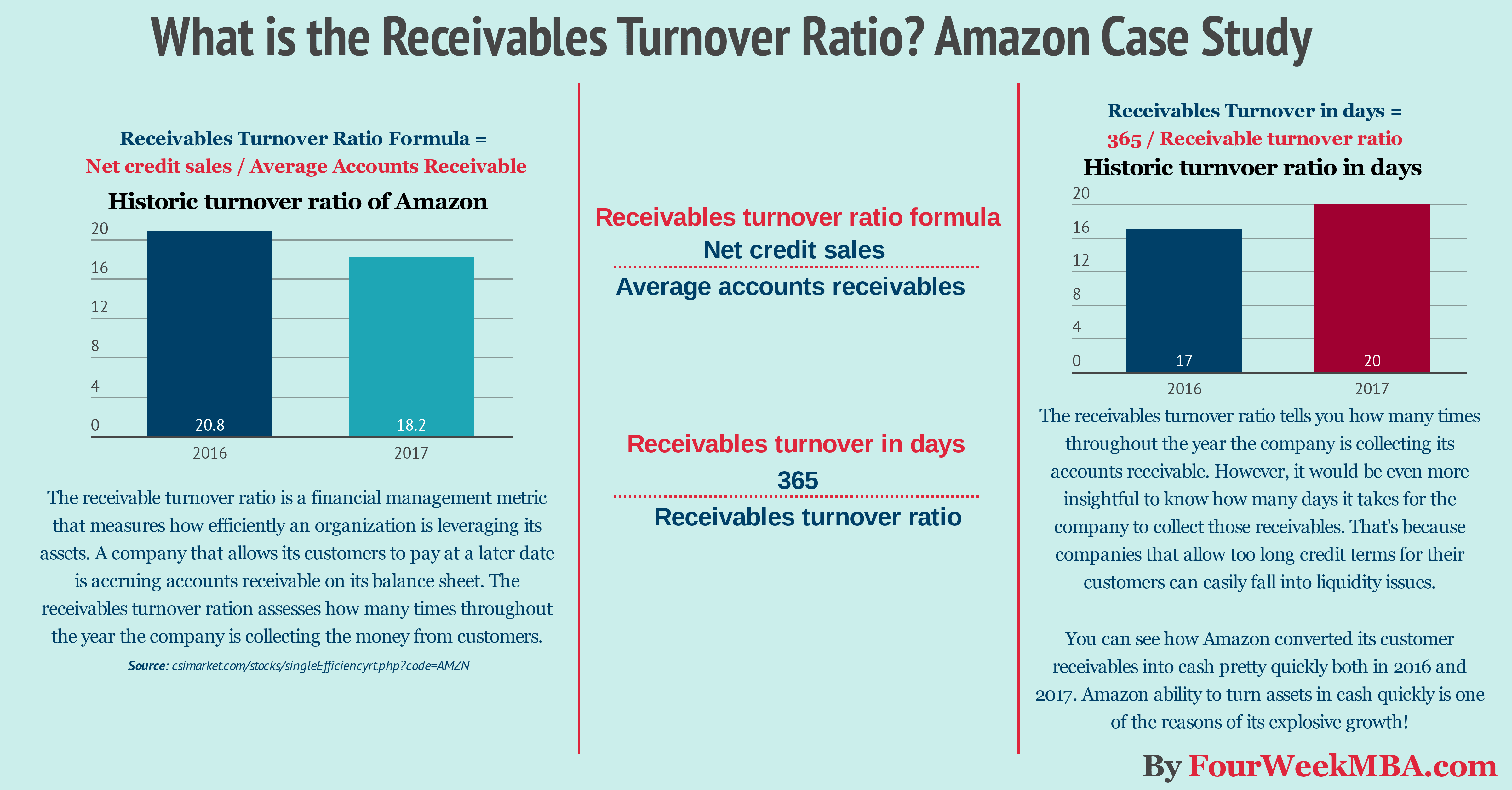

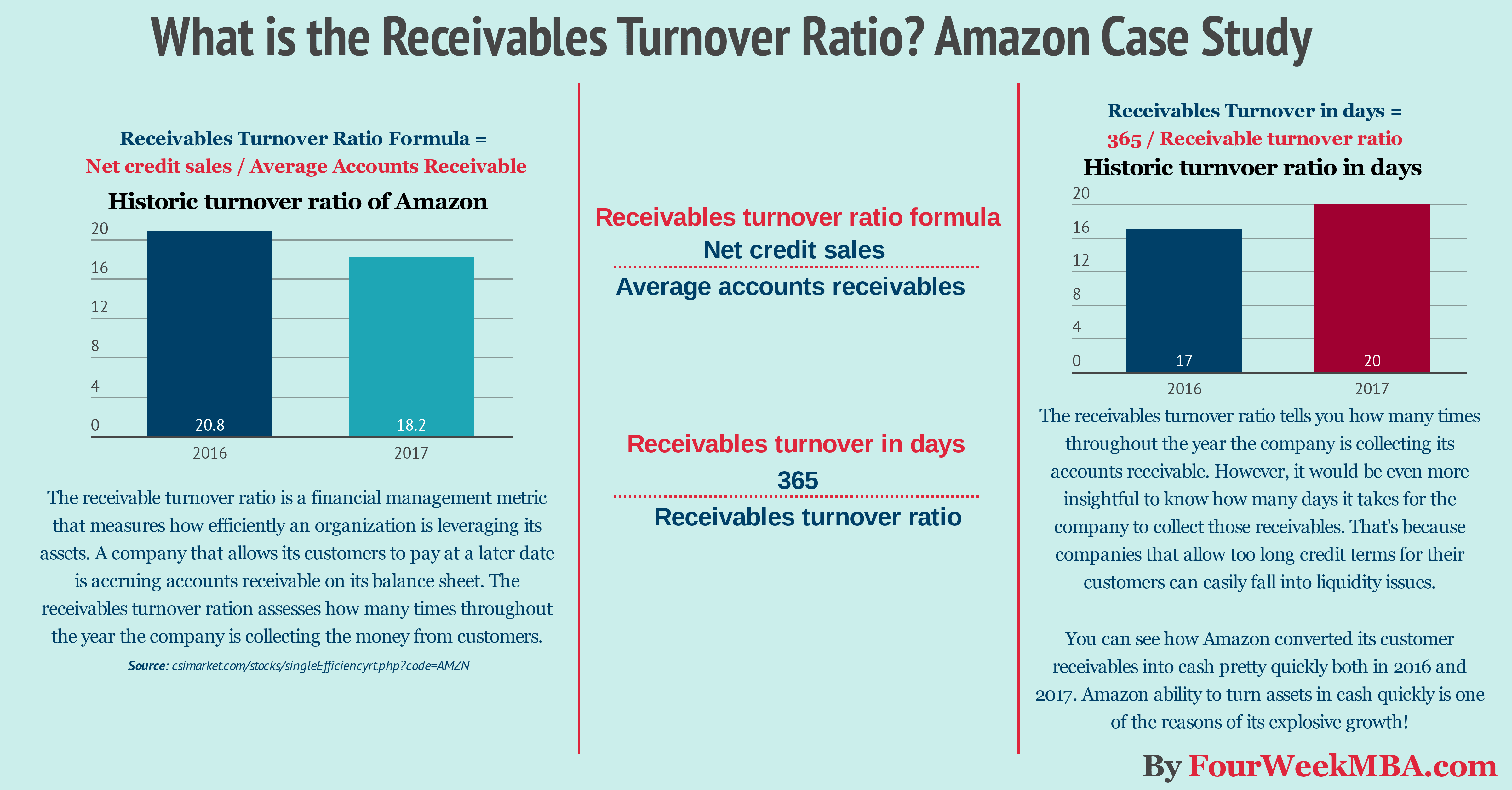

What Is The Receivables Turnover Ratio Fourweekmba

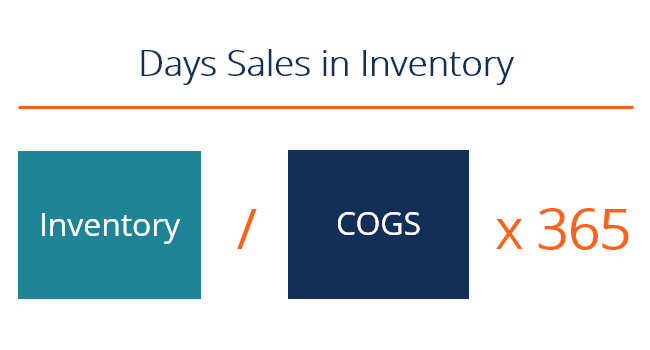

The denominator (Cost of Sales / Number of Days) represents the average per day cost being spent by the company for manufacturing a salable product The netTotal credit sales over that time period; Accounts Receivable Days Example Shoeburger Corp, a small business that sells burgers to local fast food restaurants, has a receivables balance of $0,000 on December 31 The company had annual sales of $2,0,000 for the year

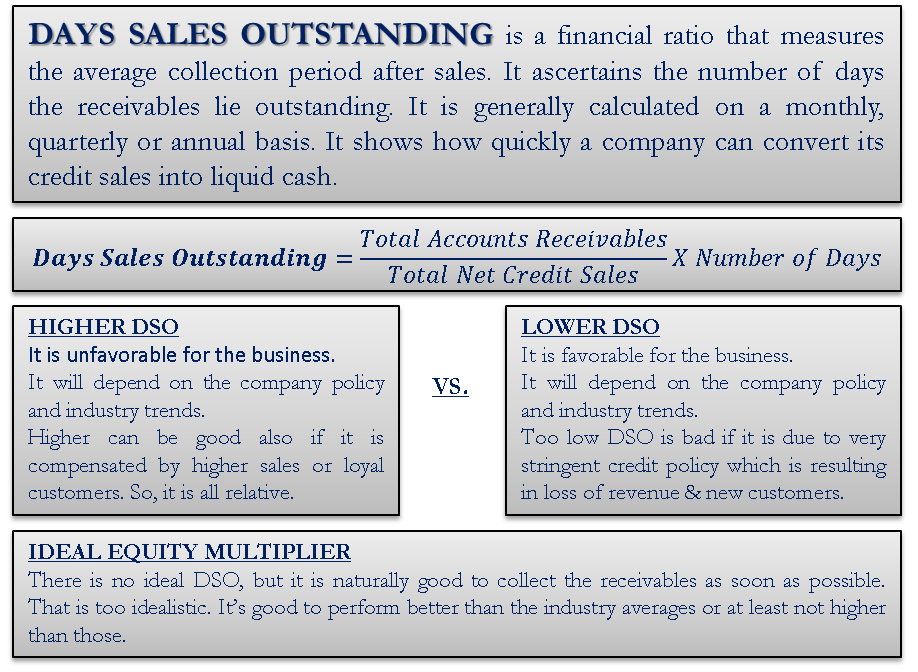

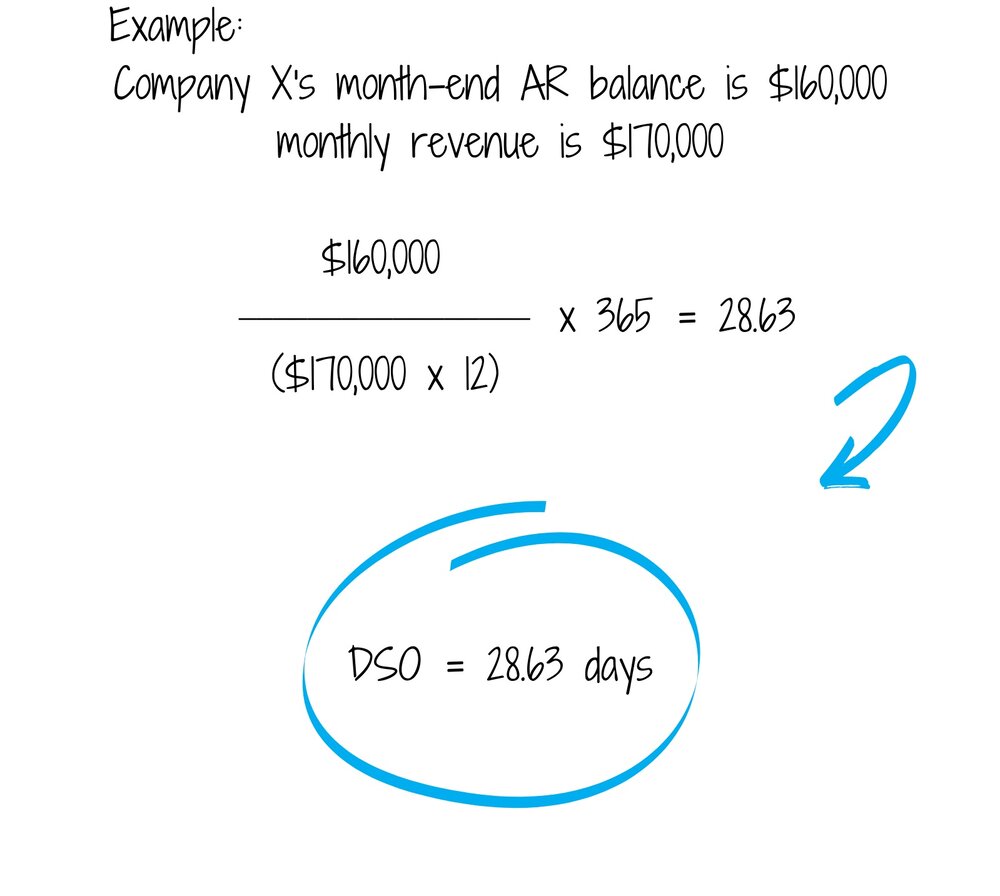

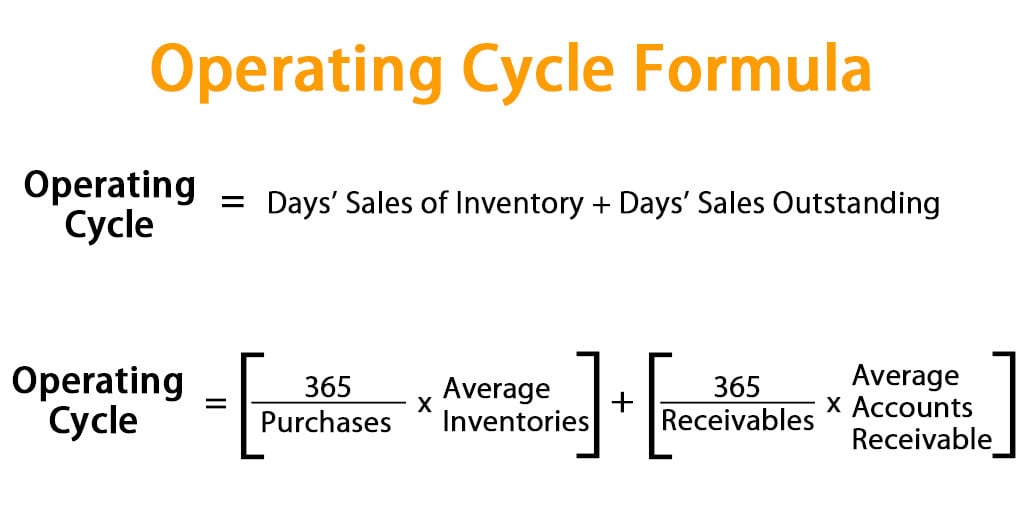

The days sales outstanding formula can be written as (accounts receivable / sales revenue) X number of days in measured period = DSO An effective way for businesses to use the DSO calculation is to keep it tracked month by month on a trend line or a series of plotted data points indicating a certain pattern or direction Using the DSO in The CCC is also referred to as the net operating cycle This cycle tells a business owner the average number of days it takes to purchase inventory, and then convert it to cash That is, it measures the time it takes a business to purchase supplies, turn them into a product or service, sell them, and collect accounts receivable (if needed) Calculating Days in A/R A/R Days = (Accounts receivable ÷ Annual revenue) x Number of days in the year First, you'll need to calculate your practice's average daily charges Add all of the charges posted for a given period 3 months, 6 months, 12 months Subtract all credits received from the total number of charges

Thus, the formula is Average accounts receivable ÷ (Annual sales ÷ 365 days) Example of Days Sales Outstanding The controller of Oberlin Acoustics, maker of the famous Rhino brand of electric guitars, wants to derive the days sales outstanding for the company for the April reporting periodThe formula for Days Sales Outstanding is The numerator of this ratio is ending accounts receivable, taken from the balance sheet at the end of the period you're looking at For our example, let's assume it's $1,000 The denominator is revenue per day, take the annual sales figure divided by the number of days in a year, or 360 to useThe "365" refers to the number of days contained in the recording period If you calculate an overall estimate of Daily Sales Outstanding for the year, utilize 365 as an appropriate figure;

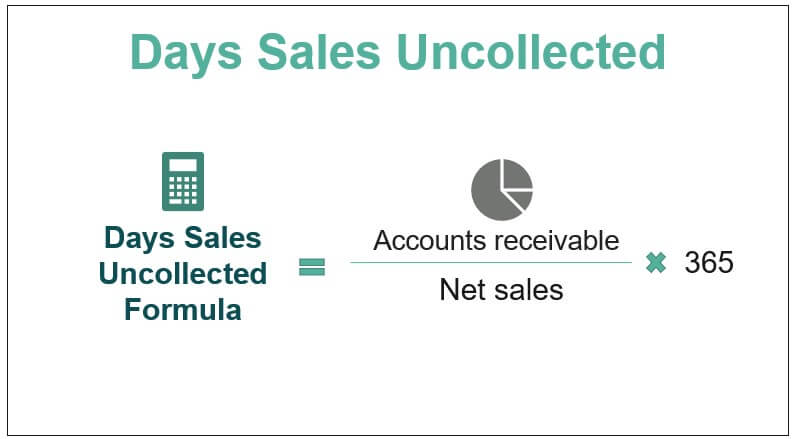

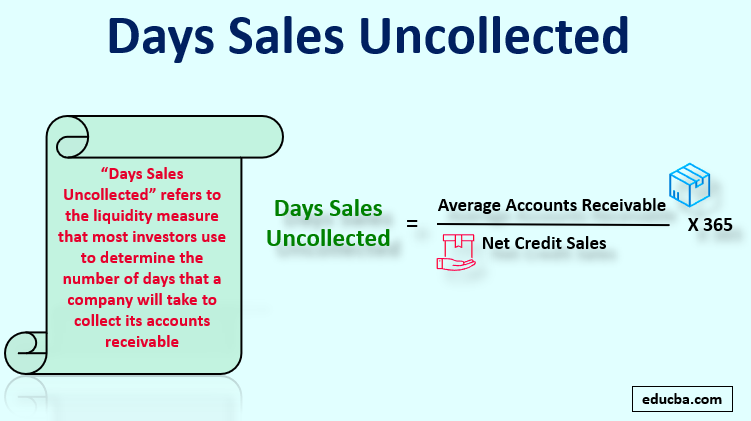

Days Sales Uncollected Different Examples With Limitations

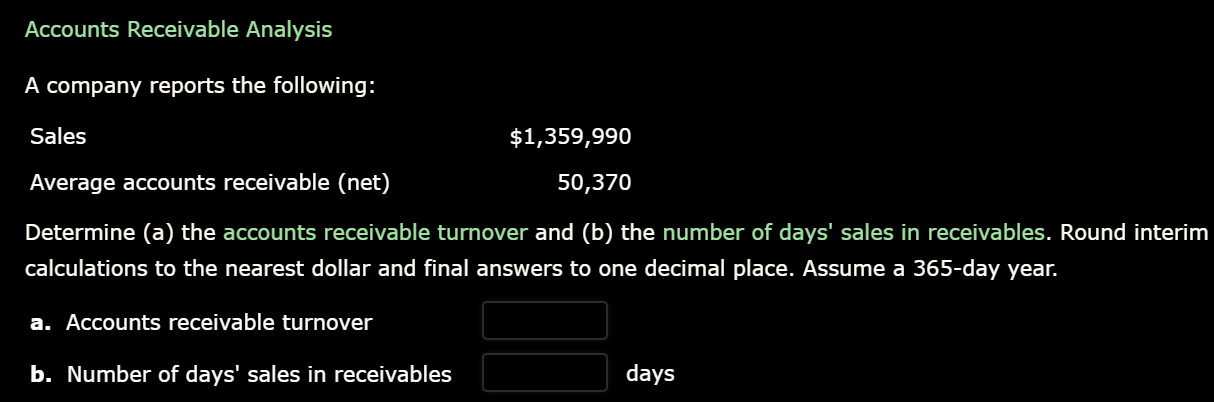

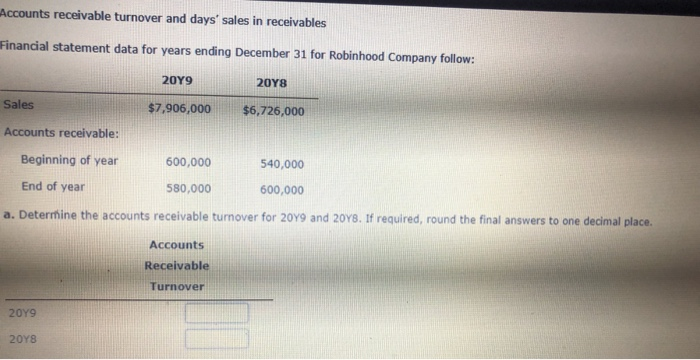

Accounts Receivable Turnover And Number Of Days Chegg Com

This will affect the Measured Period portion of the formula If we are calculating monthly DSO, the measured period will be the number of days in that month, likewise for quarterly or yearly DSO Current AR Balance A company's AR balance is the dollar value of their accounts receivable Credit Sales During Measured PeriodThe days sales outstanding formula is DSO = (Average Accounts Receivable / Total Credit Sales) x (Number of Days) How To Calculate Days Sales Outstanding (Or DSO) Let's take an example to show how the days sales outstanding formula works Suppose you own a Average accounts receivable = (,000 30,000) / 2 = 25,000 Days sales outstanding = Average accounts receivable / (Sales / 365) Days sales outstanding = 25,000 / (0,000 / 365) Days sales outstanding = 4563 days It takes the business on average 4563 days to collect accounts receivable from customers Days Sales Outstanding Example 2

Day S Sales Uncollected Formula Step By Step Calculation Examples

Days Sales Outstanding Define Formula Calculate Analysis Ideal Dso

Accounts Receivable Turnover (Days) (Year 1) = 266 ÷ (3351 ÷ 360) = 28,5 Accounts Receivable Turnover (Days) (Year 2) = 325 ÷ (3854 ÷ 360) = 30,3 Accounts Receivable Turnover in year 1 was 28,5 days It means that the company was able to collect How to calculate Days Sales Outstanding with the DSO formula DSO calculation can be done using this simple formula Days Sales Outstanding = (Accounts Receivable/Net Credit Sales)x Number of days Example John, a small business owner, sells his goods and collects payments from his customers within 30 days of each sale While most customers The formula for calculating days sales outstanding is Accounts receivable ÷ Total Credit Sales x Number of Days in Period If you're ready to calculate the days sales

Days Sales Outstanding Calculator Plan Projections

Days Sales Outstanding Template Download Free Excel Template

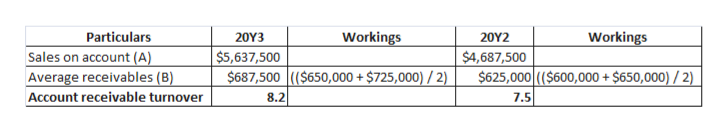

Accounts Receivable Turnover in Days The accounts receivable turnover in days shows the average number of days that it takes a customer to pay the company for sales on credit The formula for the accounts receivable turnover in days is as follows Receivable turnover in days = 365 / Receivable turnover ratio Now, let's understand how to calculate days of working capital with an example Take balance sheet excerpts of ABC Ltd which has annual revenue of $37,500,000 Days Working Capital = Net Operating Working Capital / Average Daily Sales Days Working Capital = 157,500 / Your ending accounts receivable balance;

Debtor Days Ratio Double Entry Bookkeeping

How To Analyze The Accounts Receivable Turnover Ratio Magnimetrics

Add the two receivables numbers ($1,1,363 $1,178,423) and divide by two This results in average accounts receivable of $1,180,3 Now you have the figures you need to calculate the equation Just plug the numbers in Credit sales ÷ average receivables = accounts receivable turns $15,608,300 ÷ $1,180,3 = accounts receivable turnsDays of Sales Outstanding (DSO) = (Avg Accounts Receivable / Net Credit Sales) * Number of Days Days Sales Outstanding Equation Components Avg Account Receivables The sum of total accounts receivable at the beginning of the period and the amount of receivables at Days Sales Outstanding (DSO) is an estimate of the number of days it takes a company or organisation to collect its outstanding accounts receivable – in the most simple terms, it's a measure of how long it takes your customers to pay an invoice

Accounts Receivable Formula Importance Impact

Days Sales Outstanding Kpi Sense

To determine how many days it takes, on average, for a company's accounts receivable to be realized as cash, the following formula is used DSO = Accounts Receivables / Net Credit Sales X Number of DaysDays Sales Outstanding Formula Here is the DSO formula below Days Sales Outstanding Formula = Accounts Receivables Accounts Receivables Accounts receivables refer to the amount due on the customers for the credit sales of the products or services made by the company to them It appears as a current asset in the corporate balance sheet read more / Net Credit Sales *Avg Accounts Receivables The average between the total accounts receivable outstanding in the beginning of the time period being evaluated and the end period The result of this formula is expressed as the number of times net credit sales have been collected during that time period For example, a ratio of 5 means that the accounts receivable

Days Sales In Inventory Dsi Overview How To Calculate Importance

The Number Of Days Sales In Receivables A Chegg Com

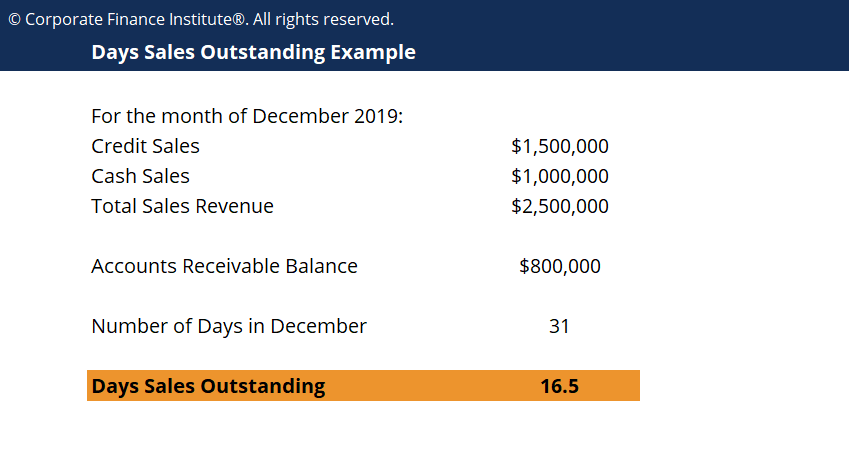

When using this average collection period ratio formula, the number of days can be a year (365) or a nominal accounting year (360) or any other period, so long as the other data—average accounts receivable and net credit sales—span the same number of days Often days sales outstanding (commonly referred to simply as DSO) is used as a measure of the average number of days it takes for a company to collect on its credit sales, using the accounts receivable balance at the end of a period and the amount of credit sales for that period Days sales outstanding is closely related to accounts receivableAccounts Receivable Days = (1,000 / 800,000) x 365 = 5475 This tells us that Company A takes just under 55 days to collect a typical invoice

Operating Cycle Formula Laptrinhx

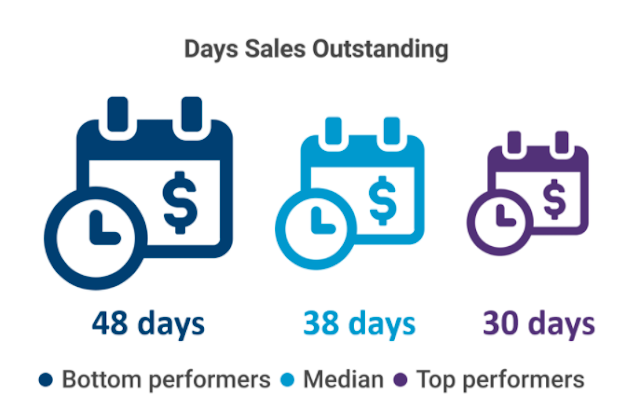

Why Dso Should Be A Focus Kpi For Your Company Intellichief

If a company has an average accounts receivable balance of $0,000 and annual sales of $1,0,000, then its accounts receivable days figure is ($0,000 accounts receivable ÷ $1,0,000 annual revenue) x 365 days = 608 Accounts receivable days The calculation indicates that the company requires 608 days to collect a typical invoice DSO = (accounts receivable) / (total credit sales) x (number of days in given time period) In the formula, the accounts receivable is divided by the credit sales for a specified number of days, and then multiplied by that number of days The result is the days sales average, which can give insight into how a business generates cash flowDefinition Accounts receivable collection period sometime called the days sales outstanding is simply mean the period (number of days) in which credit sales are collected from customers This ratio is very important for management to assess the collection performance as well as credit sales

Slides Show

Net Sales Cost Of Goods Sold Average Accounts Receivable For The Year Accounts Receivable At Year End Homeworklib

Imagine Company A has a total of £1,000 in their accounts receivable, along with an annual revenue of £800,000 Then, you can use the accounts receivable days formula to work out your total as follows Accounts Receivable Days = (1,000 / 800,000) x 365 = 5475 This tells us that Company A takes just under 55 days to collect a typicalThe business has average accounts receivable of $250,000 and net credit sales of $400,000 with 365 days in the period Because their income is dependent on their cash flow from residents, she wants to know how the company has been doing with their average collection period inFormula for Days Sales Outstanding To calculate DSO, you should divide the accounts receivable of a period by the total net credit sales, and then multiply the result by the total number of days in the period The formula for calculating DSO is as follows DSO = Accounts Receivables / Net Credit Sales X Number of Days What Does a High or Low

What Is Days Sales Outstanding Dso Accountingcapital

Objective 5 Calculate The Acid Test Ratio And Days Sales In Receivables Ppt Download

The formula used to arrive at the days sales outstanding number in the chart above is shown below DSO = (Accounts Receivable / TTM Credit Sales) X 365 Days The ratio in the chart above is expressed in days Tesla's TTM credit sales can be derived from the accounts receivable to TTM revenue ratio which we saw earlier (Accounts Receivable/ Total Sales) x Number of Days = DSO For example, if you wanted to calculate the annual DSO for a business with $225M in it's A/R balance sheet and $150M in total sales, the formula would look like this ($22,500,000 / $150,000,000) x 365 = 5475 daysTherefore, when the turnover rate increases, the number of days' sales in accounts receivable will decrease This is so because, Days' sales in receivables = 365 days / Receivables turnover

What Is The Receivables Turnover Ratio Fourweekmba

Days Sales Outstanding Double Entry Bookkeeping

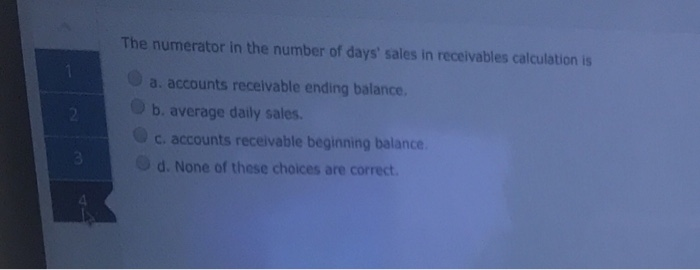

Number of days sales in accounts receivable = Beginning accounts receivable / average daily sales Estimated ending accounts receivable = estimated sales for the month / 30 days * number of days sales in accounts receivable Collections = estimated sales for the month beginning accounts receivable – estimated ending accounts receivableThe formula for number of days' sales are in receivable is 365 days in a year / accounts receivable turnover The direct write off method does not use _____ account an allowance The net realizable value is Accounts Receivable of Allowance for Days receivable is the collectability of accounts receivable, answering the question "how fast can cash supply be built?" with a number of days Calculating this number of days receivable helps determine if a change in receivables is a result of a change in sales Comparing days receivable with the company's credit terms indicates how

Understanding Days Sales Outstanding Day Understanding Accounts Receivable

How To Improve Debtor S Receivable Turnover Ratio Collection Period

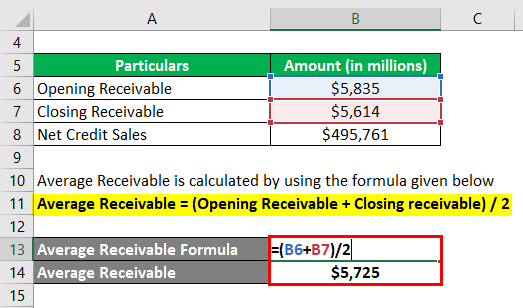

Representing the 365 days in the year Accounts Receivable Explanation The average accounts receivable is fairly straight forward This figure

/calculate-cash-conversion-cycle-393115-v4-JS2-869f1dcda7b744abb1b815b2fd25c031.png)

Calculating The Cash Conversion Cycle Ccc

Accounts Receivable Turnover And Days In Sales Receivable Financial Services Economies

Days Sales Outstanding Dso Definition Formula Importance

Days Sales In Accounts Receivable Business Forms Accountingcoach

/calculate-cash-conversion-cycle-393115-v4-JS2-869f1dcda7b744abb1b815b2fd25c031.png)

Calculating The Cash Conversion Cycle Ccc

How To Calculate Days Sales Outstanding Or Dso Calculation Paysimple

Receivables Chapter 8 Chapter 8 Explains Receivables Ppt Download

Days Sales In Receivables Example Youtube

9 Tips To Improve Your Accounts Receivable Turnover Enkel

Chapter 15 Financial Statement Analysis Financial And Managerial

Week 5 Learning Journal Studocu

Slides Show

4 Ways To Reduce Your Company S Days Sales Outstanding Dso Receeve Gmbh

What Is The Accounts Receivable Days Formula Gocardless

Accounts Receivable Turnover Ratio Formula Examples

Measure And Manage Collection Efficiency Using Dso Abc Amega

Continuing Company Analysis Amazon Accounts Receivable Turnover And Number Of Days Sales In Receivables Amazon Com Is One Homeworklib

Answered Calculate Activity Measures The Bartleby

Days Sales Outstanding Dso Ratio Formula Calculation

How To Calculate Days Sales Outstanding Dso Finance Friend

Average Collection Period Advantages Examples With Excel Template

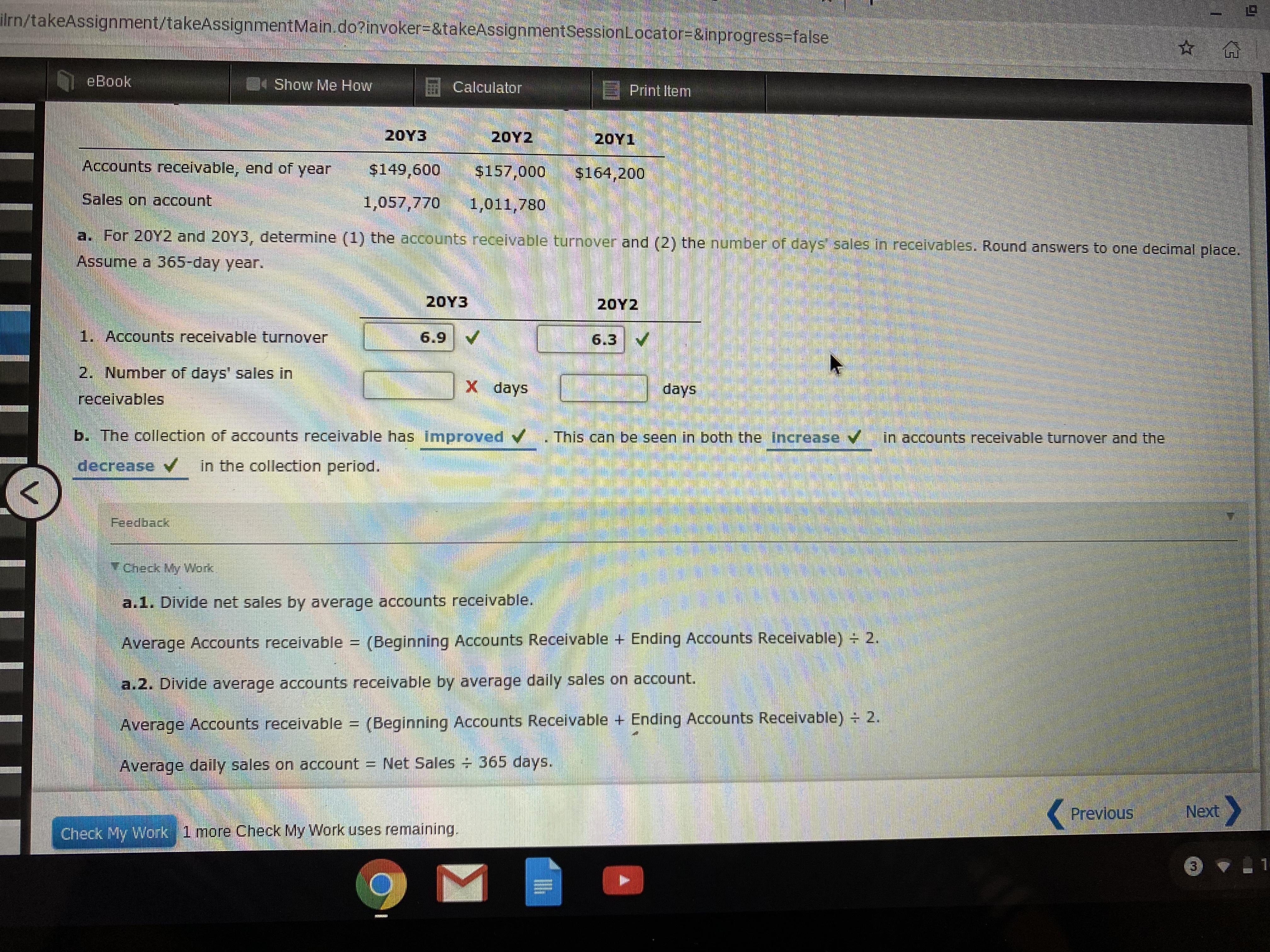

Answered Ilrn Takeassignment Takeassignmentmain Bartleby

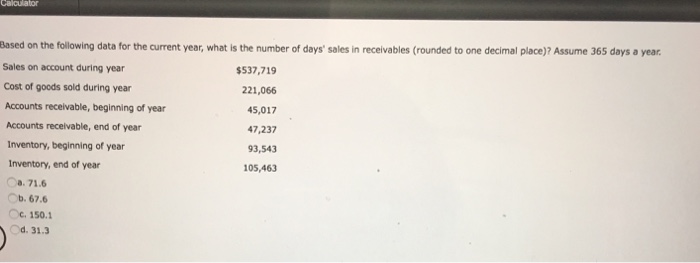

Based On The Following Data For The Current Year Chegg Com

Debtor Days Meaning Formula Calculate Debtor Days Ratio

Accounts Receivable Turnover And Days Sales In Receivables Classic Company Designs Markets And Distributes A Variety Homeworklib

Goals

Answered Accounts Receivable Analysis A Company Bartleby

08 Ohp Slides 1

Accounts Receivable Turnover Ratio Formula Examples

Days Sales Outstanding Formula Meaning Example And Interpretation

What Is Dso Why Dso Is Vital For Accounts Receivable Billtrust

Days Sales Outstanding Examples With Excel Template Advantages

What Is Days Sales Outstanding Dso Accountingcapital

Q Tbn And9gcrc09u0jqh9tklpssdcp0zakjbjyvrtfu3nhuc5k9ddrcu9f 5g Usqp Cau

1

Financial Statement Analysis Chapter 9 Ppt Download

1

A Step By Step Guide To Calculating Days Sales Outstanding The Blueprint

Accounts Receivable Turnover Days

F Xzppblgjkxnm

Nobles Fin5 Ppt 15

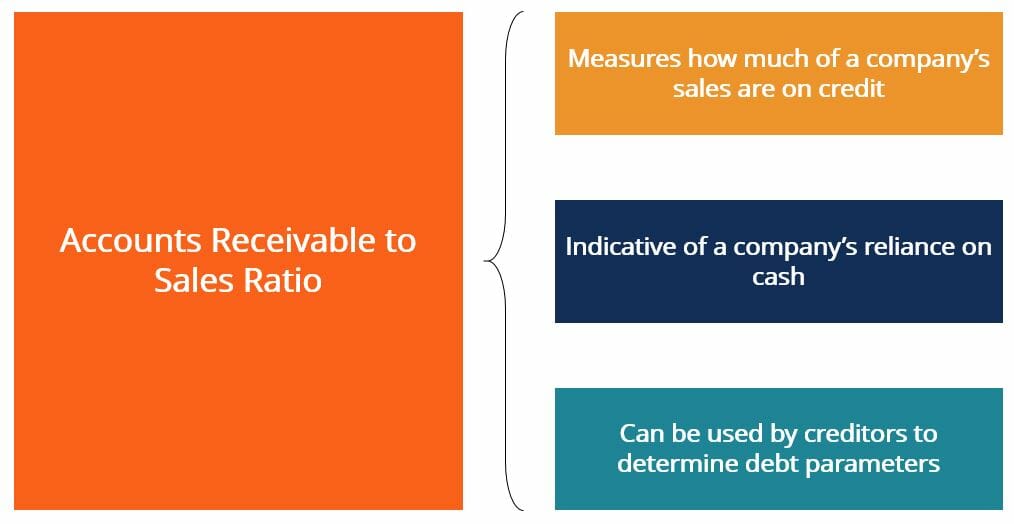

Accounts Receivable To Sales Ratio How To Calculate The Ratio

Day Sales Outstanding Formula Calculator Scalefactor

Accounts Receivable Analysis A Company Reports The Chegg Com

Los 7 Monitoring Accounts Receivable Learning Outcome Statement

Days Sales Outstanding Dso Definition

Match The Ratio With The Formula A Days Sales In Chegg Com

Measuring Days Sales Outstanding Dso Calculator

Nobles Fin5 Ppt 15

Days Sales Outstanding Formula Meaning Example And Interpretation

Days Sales Outstanding Examples With Excel Template Advantages

Solved Accounts Receivable Turnover Days Sales In Receivables Inventory Turnover Net Revenue Average Ar Average Ar Net Revenue 365 Cost Of Goods Course Hero

Http Www Gleim Com Public Accounting Updates Cpa Bec 19 Updates Sept 19 Pdf

Answered Accounts Receivable Analysis The Bartleby

1

Chapter 6 Liquidity Of Shortterm Assets Related Debtpaying

Accounts Receivable Analysis A Company Reports The Chegg Com

What Is The Receivables Turnover Ratio Fourweekmba

How To Calculate Days Sales Outstanding Or Dso Calculation Paysimple

Days Sales Outstanding Dso Knowledge Center And Forum 12manage

Slides Show

Accounts Receivable Turnover Ratio Formula Examples

Days Sales Uncollected Different Examples With Limitations

Days Sales Outstanding Dso Definition Calculation And Formula Zoho Books

Accounts Receivable Turnover And Days Sales In Chegg Com

Accounts Receivable Turnover Ratio Formula Examples

1 After Studying This Chapter You Should Be Able To 9 Receivables Objective 2 Describe The Nature Of And The Accounting For Uncollectible Receivables Ppt Download

Days Sales Outstanding Examples With Excel Template Advantages

Days Sales Outstanding Meaning Formula Calculate Dso

Receivables Turnover Vs Days Sales Outstanding Dso What S The Difference Gaviti

Answered Accounts Receivable Analysis A Company Bartleby

Days Sales Outstanding Average Collection Period Youtube

O Days Sales In Average Receivables Or Days Sales Chegg Com

O Days Sales In Average Receivables Or Days Sales Chegg Com

What Is Days Sales Of Inventory Dsi Ccc Dio Dso Dpo

Chapter 8 Receivables Learning Objectives 1 Define And

Answered Sat 11 40 Pm Help Cory Bookmarks Window Bartleby

How To Calculate Days Sales Outstanding Or Dso Calculation Paysimple

Days Sales Outstanding Average Collection Period Youtube

Solved Q Sat 11 40 Pm Hel Answers Course

Receivables Chapter 8 1 Copyright 12 Pearson Education

The Best Possible Measures To Improve Dso Kapittx

0 件のコメント:

コメントを投稿